3 Reasons Hospitals Overlook Liens and How to Successfully Pursue Them

Author: David Rothgerber – Senior Vice President, MVA Services

What is a hospital lien? A “lien” is simply a legal interest or entitlement to a portion of any settlement in a personal injury case. The hospital that treats a patient after an accident may be allowed to recover some of the money paid in a personal injury settlement.

From the hospital’s perspective, they provided treatment and know that an insurance company may compensate to cover medical expenses associated with this treatment. This helps ensure that our healthcare systems remain financially sound and incentivizes them to adequately treat patients for injuries.

The most common scenario for a hospital lien is where the patient was injured in a car accident and another party was at fault. However, a lien can and should be filed any other time where the patient was injured and is bringing a liability claim or lawsuit against an individual or entity that the patient believes is liable. This includes the patient making a claim for injuries on another’s property due to no fault of the patient (animal bites, etc.).

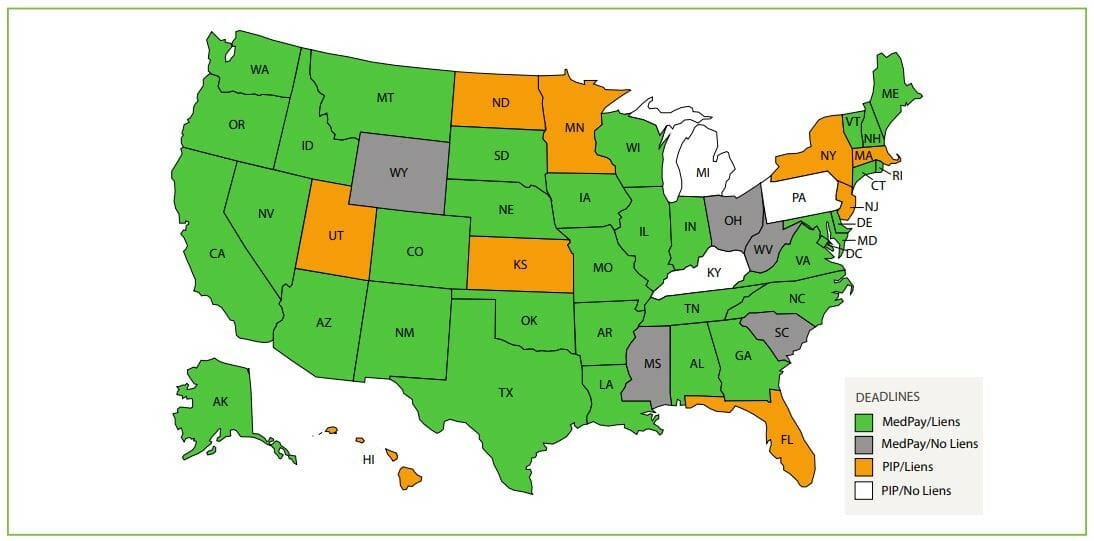

Here is a recent example – I was on a call with a potential client discussing the handling of their Motor Vehicle Accident (MVA) claims. We quickly discovered that they were not currently filing hospital liens at all. As we further discussed their MVA workflow processes with their leadership team, it became apparent that they are leaving a significant amount of revenue uncollected/written-off due to not utilizing this legal avenue to protect their rights. The state in which their facility is located has a very strong lien statute that protects the provider’s interests regarding any third-party liability (TPL) settlements. Each state’s laws differ to some extent and normally the procedures and deadlines for filing a hospital lien must be followed exactly. Also, each state’s laws can differ on who is liable if the lien is ignored and how long a hospital must enforce the lien should that happen. It is also important to note that some states do not have any hospital lien laws whatsoever.

There are three main hurdles that hospitals face that interfere with pursuing liens:

- Fear of dealing with legal requirements: Due to the legal nature of lien filing, many hospitals are fearful that they may cause more trouble/issues with the filing of liens and the attorney involvement of enforcing those liens.

-

- Solution: Utilizing a third-party technology partner allows providers to take advantage of a dedicated MVA legal team that have the necessary skills and resources to effectively appeal, negotiate and recover payments on behalf of the hospital. The right MVA business partner, like EnableComp, has a legal team that meets all legal requirements in that state to ensure that you are compliant. That same legal team will monitor state laws and cases that could impact the lien process in your state.

- Manual tracking and monitoring of the legal process: Most hospital EMR systems use a manual process and are not designed to handle the various workflows that may be necessary to properly manage the lien filing.

-

- Solution: A successful MVA business partner will have their own technology that automate and expedite payment to ensure deadlines are met and are in legal compliance with state laws. EnableComp’s proprietary technology tools use RPA (Robotic Process Automation) driven rules engine and workflows to adhere to specific state lien laws.

- Lack of experienced staff to appropriately handle the legal process: Hospital staff turnover is a constant issue especially in revenue cycle. Having staff that can manage your lien process, keep up with deadlines, and hold their own with attorneys trying to settle and or avoid liens can be a nightmare.

-

- Solution: EnableComp has an experienced staff that manage the lien process, and a team of attorneys that will negotiate and defend hospital liens to ensure that the TPL settlement is the maximum amount in which hospitals are legally entitled.

MVA claims usually make up a small percentage of overall AR for a hospital, however due to the tight margins that all hospitals are under, it is critical that you use every possible resource at your disposal to maximize recoveries. Additionally, TPL settlements at times provide you the potential to recover a higher percentage of total charges than billing commercial or government payers. If you are not filing liens and securing your rights to that TPL settlement, real revenue is left on the table. The right MVA business partner can ensure that your organization can eliminate that fear, manual work, and lack of experience to improve revenue.

The importance of a compliant MVA claims management system cannot be overstated. EnableComp is a partner that encompasses all aspects of a hospital claim from Commercial, PIP, and MVA/TPL payers. With the resources and expertise to manage MVA claims at multiple stages of their lifecycle, EnableComp ensures providers are paid the right amount in a reasonable time, while remaining compliant and respecting the patient experience. Our clients are currently experiencing more than a 25% increase in collections. Contact us to learn more.

Contact:

Andy Hatfield

Vice President, Client Services

EnableComp

ahatfield@enablecomp.com